In all the media coverage I have viewed over the course of the past few weeks I failed to hear anyone who put forth a compelling argument as to what they were protesting against. Then I saw this young man and I was truly blown away. Here is a young man who truly understands what is going on in this country and gives one of the best speeches I have heard in a long time.

Showing posts with label Federal Reserve. Show all posts

Showing posts with label Federal Reserve. Show all posts

Saturday, October 8, 2011

Wednesday, August 10, 2011

Lets Take A Moment To Dissect Bernake's Latest Zero Interest Rate Policy

by: Bruce Krasting / ZeroHedge.com

I had this to say last week:

Having been shocked, my thoughts.

The Fed could easily attempt to buy some market peace by issuing a statement that the policy of zero interest rates would be extended for a minimum period of one year. I consider this to be a “high probability" to happen in the next 30 days.I got it right, but I got it completely wrong. I feared that the Fed could extend the ZIRP language for as long as a year. Not in my wildest dream did I think they could take the extremely risky move of guaranteeing that interest rates will remain at zero for another 24 months.

Having been shocked, my thoughts.

Sunday, August 7, 2011

Black Monday? - Economic Collapse A Mathematical Certainty, The Top 5 Places Where Not To Be When It Happens!

The dollar collapse will be the single largest event in human history. This will be the first event that will touch every single living person in the world. All human activity is controlled by money. Our wealth,our work,our food,our government,even our relationships are affected by money.

No money in human history has had as much reach in both breadth and depth as the dollar. It is the de facto world currency. All other currency collapses will pale in comparison to this big one. All other currency crises have been regional and there were other currencies for people to grasp on to.

This collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets. The repercussions to this will have incredible results worldwide.

Friday, June 24, 2011

"Stealth QE3" Comes to Fruition – Soaring Inflation is Next

By David Zeiler

Associate Editor, Money Morning

U.S. Federal Reserve Chairman Ben Bernanke did what most everyone expected Wednesday at the culmination of the Federal Open Market Committee's (FOMC) two-day meeting - he left average Americans vulnerable to the pangs of higher prices and soaring inflation.

Indeed, as yet another FOMC meeting drew to a close without any significant policy changes, the central bank, as many predicted, kept interest rates at 0% to 0.25%, where they've been since December 2008.

Associate Editor, Money Morning

U.S. Federal Reserve Chairman Ben Bernanke did what most everyone expected Wednesday at the culmination of the Federal Open Market Committee's (FOMC) two-day meeting - he left average Americans vulnerable to the pangs of higher prices and soaring inflation.

Indeed, as yet another FOMC meeting drew to a close without any significant policy changes, the central bank, as many predicted, kept interest rates at 0% to 0.25%, where they've been since December 2008.

Saturday, May 14, 2011

Inflation Is Already Here

The recent correction in the commodities markets may be providing Bernake, Geithner and their easy money acolytes with a sense of relief given the relentless run up in prices of raw materials since the announcement of QE back in 2008, but they should not sleep tight just yet. As anyone in the markets will tell you, when any underlying commodity has a price move so vertical in its trajectory it’s bound to face a correction as the smart money, having gotten in for fundamental reasons much earlier along the trend line now wait for the panic buyers or the Johnny-come-lately’s to give the rally that last unsustainable spike to unload their longs and leave the suckers holding $40.00 silver in their purses.

Wednesday, May 11, 2011

Forbes Predicts U.S. Gold Standard Within 5 Years

“What seems astonishing today could become conventional wisdom in a short period of time,” Forbes said.

Tuesday, May 10, 2011

The Global Dollar Dump Is Already in Progress

The following quotes signal the beginning of the End Game for the US Dollar:

The following quotes signal the beginning of the End Game for the US Dollar:“We hope the U.S. government will take responsible policies and measures to safeguard investors’ interests,” [China’s ministry] said in a statement.

“Foreign-exchange reserves have exceeded the reasonable levels that we actually need,” [China’s central bank governor] said. “The rapid increase in reserves may have led to excessive liquidity and has exerted significant sterilization pressure. If the government doesn’t strike the right balance with its policies, the build-up could cause big risks,” he said, without elaborating.

These two statements, in plain terms, are China saying it’s sick of the US Dollar.

Friday, May 6, 2011

Americans Gone Wild

As the U.S. economy continues to collapse, Americans are going to becoming increasingly frustrated, and this frustration will inevitably boil over into rioting and violence. Could we be starting to see the start of this already? The number of Americans that have "gone wild" seems to be escalating. Years ago, losing a job was not that big of a deal. Now a job loss is enough to cause some Americans to snap and go over the edge. We are seeing restaurant brawls and open violence in the streets that would have been unthinkable 50 years ago. All over the nation people are losing it and are literally going crazy. The news stories and the videos posted below of "Americans gone wild" are very graphic and very shocking. There is a reason for this. These examples are meant to show you that the very fabric of our civilized society is falling apart. It won't matter who ends up leading us politically if this is the kind of people we become.

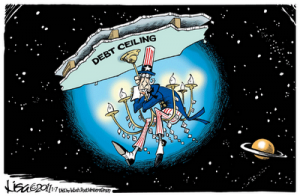

$2 Trillion Mile Marker on Road to Perdition

Thursday, May 5, 2011

A Dollar Collapse? No Way – The U.S. Dollar Rocks! (Propaganda)

Are we on the verge of a dollar collapse? Don't believe the skeptics. The truth is that there is no currency in the world that is stronger than the old greenback. The U.S. dollar is the reserve currency of the world. Virtually all of the nations on the face of the earth use it for trading and they always will. Why? Because the U.S. dollar is awesome. No currency on earth can compete with our awesomeness. So what that the dollar hit a new all-time record low against the Swiss franc today? Do you really want to move over with the Swissies and eat chocolate and make watches? No, you want to live in the land of American Idol, the NFL and apple pie - the good old USA. Who cares if it takes about a dollar and a half to buy a single euro now? Do you really want to go live with the Frenchies and eat a bunch of French bread while you wear a beret every day? Of course not. There isn't going to be a dollar collapse. As long as the USA is still number one the rest of the world is still going to need U.S. dollars. So quit your worrying.

Are we on the verge of a dollar collapse? Don't believe the skeptics. The truth is that there is no currency in the world that is stronger than the old greenback. The U.S. dollar is the reserve currency of the world. Virtually all of the nations on the face of the earth use it for trading and they always will. Why? Because the U.S. dollar is awesome. No currency on earth can compete with our awesomeness. So what that the dollar hit a new all-time record low against the Swiss franc today? Do you really want to move over with the Swissies and eat chocolate and make watches? No, you want to live in the land of American Idol, the NFL and apple pie - the good old USA. Who cares if it takes about a dollar and a half to buy a single euro now? Do you really want to go live with the Frenchies and eat a bunch of French bread while you wear a beret every day? Of course not. There isn't going to be a dollar collapse. As long as the USA is still number one the rest of the world is still going to need U.S. dollars. So quit your worrying.Tuesday, May 3, 2011

Fed Up with the Fed?

by: Thomas Sowell

When people in Washington start creating fancy new phrases, instead of using plain English, you know they are doing something they don't want us to understand.

When people in Washington start creating fancy new phrases, instead of using plain English, you know they are doing something they don't want us to understand.

It was an act of war when we started bombing Libya. But the administration chose to call it "kinetic military action." When the Federal Reserve System started creating hundreds of billions of dollars out of thin air, they called it "quantitative easing" of the money supply.

When that didn't work, they created more money and called it "quantitative easing 2" or "QE2," instead of saying: "We are going to print more dollars-- and hope it works this time." But there is already plenty of money sitting around idle in banks and businesses.

It was an act of war when we started bombing Libya. But the administration chose to call it "kinetic military action." When the Federal Reserve System started creating hundreds of billions of dollars out of thin air, they called it "quantitative easing" of the money supply.

When that didn't work, they created more money and called it "quantitative easing 2" or "QE2," instead of saying: "We are going to print more dollars-- and hope it works this time." But there is already plenty of money sitting around idle in banks and businesses.

Monday, May 2, 2011

No Buyers For Treasuries aka "Toxic Waste"

We believe there will be something similar to a QE3 by another name and the Fed will probably have to create some $2.5 trillion to buy Treasuries, Agencies, and toxic waste and perhaps inject funds into the economy. Japan certainly won’t be a buyer and probably will be a seller. China has indicated that they won’t be purchasers in the future either. The question also arises concerning the continued purchase of these securities by countries in the oil producing Gulf States, which are in turmoil. The three countries make up 45% of Treasury purchases. As we pointed out in previous issues the second half of 2011 should be monstrous. Even if the fed buys all the Treasury and Agency bonds they’ll still have to deal with a lower dollar and high inflation. Then there is high unemployment and raging gold and silver prices. There is also the question of US debt, federal, state and municipal debt, along with wars in the Middle East and North Africa. How many US Treasuries will Japan have to sell and how deeply will its slowdown effect American industry?

Sunday, May 1, 2011

Where Were You On Super Bowl Weekend?

compliments of: tfmetalsreport.com

I was in Vegas with my friend, Sweetness. He and I gambled too much. Drank too much gin and played a little golf.

Where were you? Did you watch the game? Perhaps you had a party? Maybe you're not an american football fan so you spent the weekend relaxing and catching up. Either way, like me, you had no way of knowing what was going on behind the scenes.

My next question is: Where was Ben Bernanke? Where was Tim Geithner? Where were the rest of the Fed governors and the heads of the TBTF banks? We may never know, though history one day may record their actions for posterity.

I was in Vegas with my friend, Sweetness. He and I gambled too much. Drank too much gin and played a little golf.

Where were you? Did you watch the game? Perhaps you had a party? Maybe you're not an american football fan so you spent the weekend relaxing and catching up. Either way, like me, you had no way of knowing what was going on behind the scenes.

My next question is: Where was Ben Bernanke? Where was Tim Geithner? Where were the rest of the Fed governors and the heads of the TBTF banks? We may never know, though history one day may record their actions for posterity.

Saturday, April 30, 2011

How To Buy Gas For $0.25 Per Gallon

by: Chip Wood

by: Chip WoodSome neighbors and I were reminiscing recently about "the good old days" when the talk turned to how cheap things were back then. I immediately concurred. I told them of the very first credit card I got for one of the gas-station chains. Back then gasoline cost less than 25 cents a gallon.

And then I said something that stopped them cold: "Do you know that you can still buy gasoline for 25 cents a gallon?" They were all certain that there was a trick to my question … and there is.

My claim is absolutely, totally, 100% true – if you pay with a quarter that was minted prior to 1965.

We've written many times before about how much we like "junk silver" coins – the dimes, quarters, and half-dollars the U.S. Mint produced prior to 1965. These coins are 90% pure silver. A $1000 face value bag of them contains 712 ounces of the metal.

Thursday, April 28, 2011

Food and Energy Inflation is Not Transitory

Tuesday, April 26, 2011

An “All-In” Bet By Fed Chairman Ben Bernanke

Wednesday Could Be Scary Day

Wednesday April 27th could be the scariest day of the quarter – in fact the whole year.

As you know by now, on Wednesday Federal Reserve Chairman Ben Bernanke will make history - by holding the first ever press briefing following a monetary policy decision by the central bank.

A Debt Default is Not the Real Problem for the US

article from: ZeroHedge.com

Many commentators are discussing the collapse of the US today. Indeed, the most common theme I see one of “it’s all over,” usually focusing on the math/ debt problems in the US.

Debt is a major problem, but it’s not always one that destroys everything. History is replete with countries that defaulted on their debt… and the world kept chugging along regardless.

It’s GAME OVER For the US

If the US were a company, it’d already be in Chapter 11.

FoxNews published a WHOPPER of a story yesterday, though it somehow has not caught the attention of most people. If you have issues with Fox them at the door for a moment and simply focus on the numbers.

For the first time since the Great Depression, the US is now officially paying out more in benefits than it takes in via tax receipts.

If the US were a company, it’d be spending more in salaries than it makes in sales. Aside from being unprofitable, it’s also got a MASSIVE debt load. And it’s current policy of paying out more than it makes only increases this debt load… which begs the question… who’s going to pay the interest payments on the debt?

FoxNews published a WHOPPER of a story yesterday, though it somehow has not caught the attention of most people. If you have issues with Fox them at the door for a moment and simply focus on the numbers.

For the first time since the Great Depression, the US is now officially paying out more in benefits than it takes in via tax receipts.

If the US were a company, it’d be spending more in salaries than it makes in sales. Aside from being unprofitable, it’s also got a MASSIVE debt load. And it’s current policy of paying out more than it makes only increases this debt load… which begs the question… who’s going to pay the interest payments on the debt?

Monday, April 25, 2011

The Jig Is Up For the US Dollar

by: Craig Hasten

Folks, I'm sure you are seeing a general theme forming in the material that I am posting today. In case you haven't put all the pieces of the puzzle together yet, the dollar is dying!

Now I give you an article (once again from the mainstream news) in which they are openly discussing the possibility of the United States defaulting on it's 14 trillion in debt. Once again, this has been a taboo topic these past few years and if discussed it would only end with you being publicly mocked and branded as a prime candidate for the loony bin.

Please see what is happening folks.

Folks, I'm sure you are seeing a general theme forming in the material that I am posting today. In case you haven't put all the pieces of the puzzle together yet, the dollar is dying!

Now I give you an article (once again from the mainstream news) in which they are openly discussing the possibility of the United States defaulting on it's 14 trillion in debt. Once again, this has been a taboo topic these past few years and if discussed it would only end with you being publicly mocked and branded as a prime candidate for the loony bin.

Please see what is happening folks.

Subscribe to:

Comments (Atom)