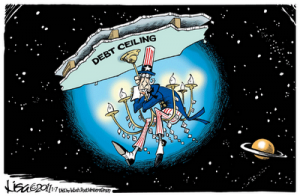

This week, Treasury Secretary Tim Geithner proposed raising the debt ceiling by $2 trillion. I thought, this should be big news! After all, a trillion is a thousand billion. This adds up to 2 thousand billion over the next 2 years!!

The mainstream media greeted this story with a great big yawn. I do not get that because the Republicans and Democrats fought for weeks to only cut the budget a measly $38 billion. The press was non-stop, and Congress was only an hour away from shutting down the government. Even the $38 billion cut was a big fat lie according to CBS News. The story said in mid-April, “Well, thanks to the Congressional Budget Office and some great reporting by the Washington Post, it turns out the government won’t be cutting $38 billion in one year after all. No, the real cuts will be more like $352 million! You heard me right, $352 million, NOT $38 billion. The rest? Mostly smoke, mirrors and accounting gimmicks.” (Click here for the entire CBS News story.)

Both parties want to cut roughly $4 trillion out of the budget over the next 10 to 12 years. Can someone please explain how that is accomplished by tacking on another $2 trillion to the national tab? I do not get the math and neither does Bill Gross, the head of the biggest bond fund in the world. He said in early January, “We have a deficit in the $1 trillion plus arena, which means we must borrow at least a trillion dollars additional a year in order to fund the deficit. And, so, the debt ceiling currently at $14.3 trillion, which is 95% of GDP, has to go up by another trillion or so every 12 months.” (Click here to read my original post on the debt ceiling.) Not long after Gross made this statement, he sold most, if not all, of his U.S Treasuries. What do you know? He was right on the money. The proposal from the Treasury is a $2 trillion increase in the debt ceiling to cover most of the next 2 years.

You see, it’s not just the Treasuries he’s worried about, but the currency he will be paid back in. A Treasury bond pays interest. Investors buy them, if they think they can get paid back enough dollars to offset inflation and make a profit. Mr. Gross is betting the dollars he would get paid back would actually be worth less when the bond matures, and thus he holds very little U.S. government debt. In a recent article, he said, “I spoke last month to the reality of investors being “skunked” and having their pockets picked simply by receiving yields less than inflation, and suggested that as a major reason why the PIMCO ship was carrying a limited supply of Treasuries on board.” (Click here to read the latest post from Bill Gross.)

The debt ceiling currently stands at $14.3 trillion and word is we will exceed that amount by August (although some say we have already exceeded it). Reuters reported this week, “Geithner said he could avoid default until August 2, but repeated his warning that a failure to raise the borrowing cap would have a “catastrophic” impact on the economy. . . .If the debt ceiling is not raised, investors may fear that the United States could not repay its loans and so would sell U.S. government bonds. That would drive down bond prices and force the United States to offer higher interest rates to make its debt more attractive to lenders — a move that would lead to a dangerous spike in interest rates throughout the economy.” (Click here for the complete Reuters story.)

But, Mr. Geithner may have another reason for the big debt limit increase. It is continued back-door bank bailouts! Earlier this year, Geithner forgave Bank of America $127 billion in possible buy-backs of toxic mortgage debt packed into government owned mortgage giant Freddie Mac. (Click here to read more on this story.) What do you bet the other big banks want the same deal? What they should be getting is investigated and indicted for ripping off the American taxpayer. Not a single financial elite has gone to jail for causing the $12 trillion meltdown of the economy and causing millions to be foreclosed upon. The U.S. Justice Department cannot find a single crime in the entire financial debacle, but Wall Street banker bonuses keep getting bigger.

Raising the debt cap by $2 trillion will be granted to Mr. Geithner. That’s about all that will get done because if Congress can’t even cut $38 billion, how can it cut $4 trillion? (That’s 4 thousand billion.) It can’t—the cuts will never materialize. America will just get more and more inflation as the dollar is printed out of thin air to cover the cost.

There is no way this ends well.

http://usawatchdog.com/raising-the-debt-ceiling/

No comments:

Post a Comment